CURRENT PROJECTS

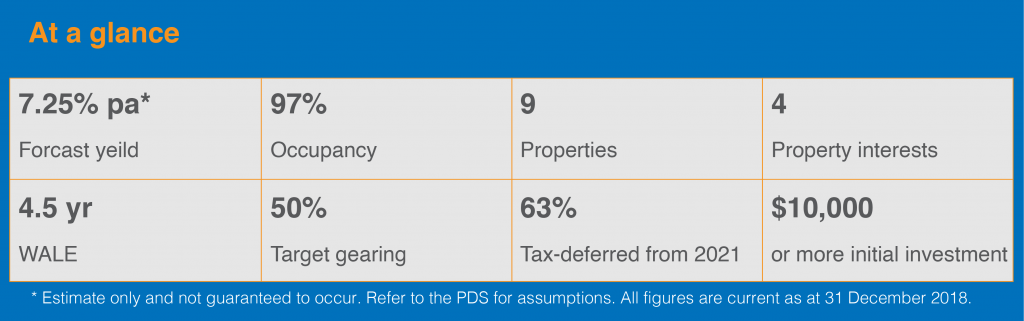

MPG RETAIL BRANDS PROPERTY TRUST

The MPG Retail Brands Property Trust provides investors with regular tax-advantaged income and the potential for capital growth through an investment in a diversified portfolio of quality properties leased to prominent retail brands. The minimum investment is only $10,000.

Features and Benifits:

Diversified portfolio predominantly leased to brand name tenants (82%)

- Attractive regular tax-advantaged returns

- Potential for capital growth

- Moderate gearing (50%)

- Defined exit strategy at 7 years (1 year remaining)

- Experienced manager with a proven track record

- Reduced capital volatility

- Minimum investment only $10,000

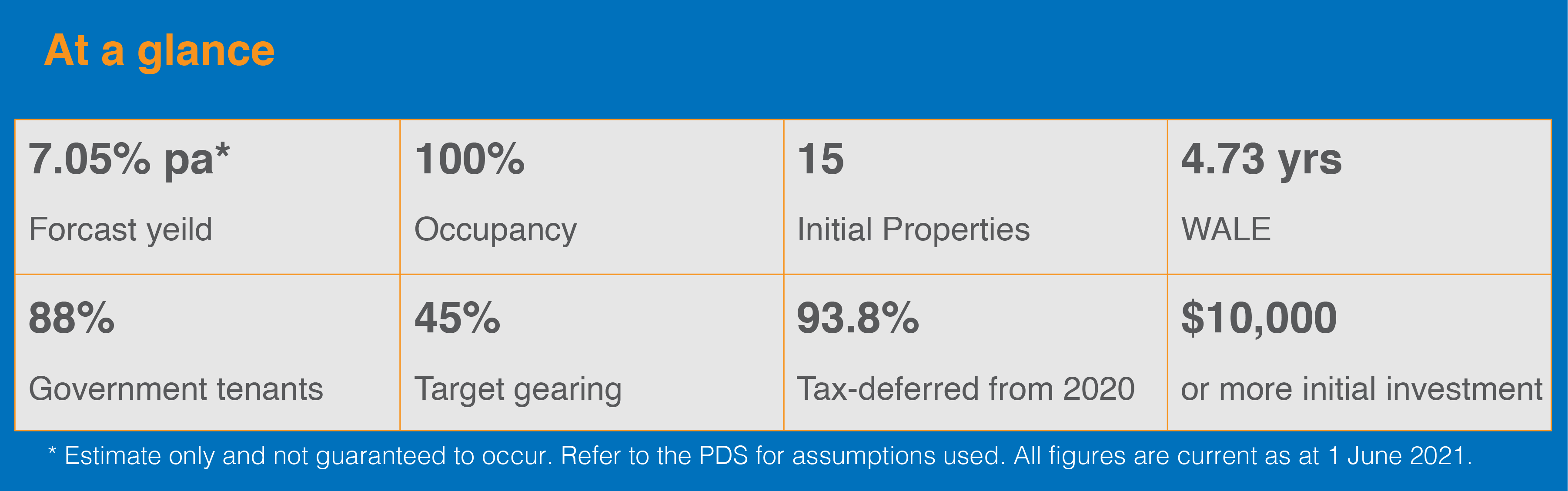

MPG Regional Cities Property Trust

An unlisted property trust.

This Trust provides investors with the opportunity to invest in a geographically diverse portfolio of quality commercial properties, with the ownership of 15 properties leased to a variety of tenants – many of which are household names such as: Bunnings, Coles, Woolworths, Rebel Sport, Liquorland, Reject Shop and JB Hi-Fi amongst others. The total value of the Investments in this Trust is $152.77million

Key Features:

- Diversified portfolio predominantly leased to government tenants (88%)

- Attractive regular tax-advantaged returns

- Potential for capital growth

- Moderate gearing (45%)

- Defined exit strategy at 7 years

- Experienced manager with a proven track record

- Reduced capital volatility

- Minimum investment only $10,000